Swipe & submit your tax return instantly.

File your return for as little as £49. We'll help you uncover your allowable expenses and submit your return directly to HMRC — fast, accurate, and stress-free.

Google Reviews

4.7

125K+

Tax returns filed for our clients.

Start Your Tax Return

Enter your details to begin your tax return.

Already have an account? Login

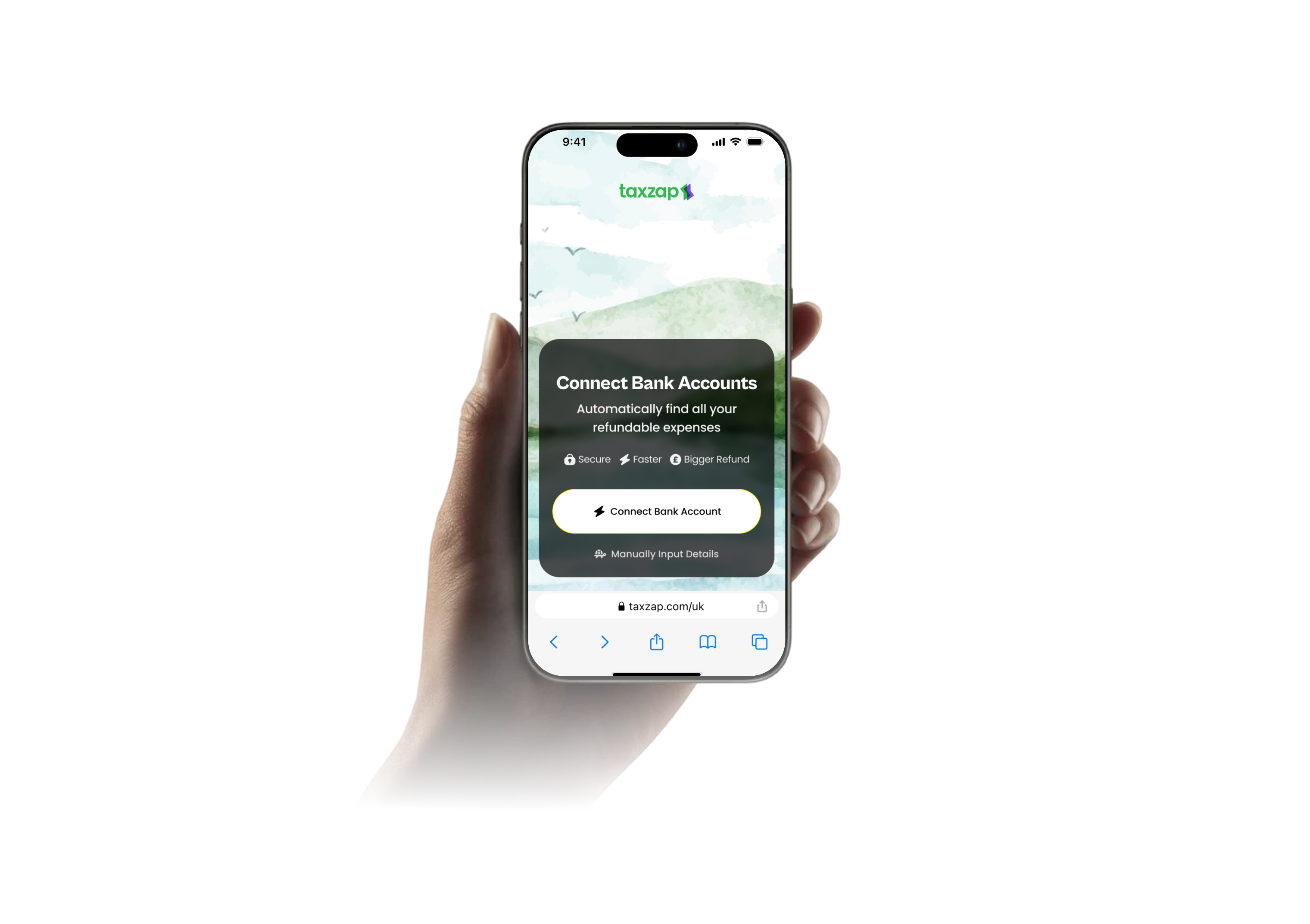

Connect your bank account to catch every expense.

Are you ... 🦺 🏠 💼 🤝 🛵?

🦺 Construction worker (CIS)

🏠 Renting out property or room

💼 Company director

🤝 Small business owner

🛵 Delivery driver

🤑 Self-employed

Delivered

125,000+ tax returns

Connect your bank account with confidence

Your data is encrypted & protected, ensuring peace of mind every step of the way.

Catch all your expenses & income

Maximize your refund by claiming every eligible expense.

Why use TaxZap?

TaxZap makes tax filing effortless — no more HMRC headaches or endless forms. Sign up and get started in minutes!

😊 TaxZap

😫 HMRC

Claim every deduction — don't miss a penny!

No forms — just fast, easy filing.

On mobile or desktop, file when it suits you.

Perfect for CIS, freelancers, and small businesses.

Bank-level encryption for safe, easy filing.

File in minutes and get back to what you love.

Save money and time with TaxZap

TaxZap is an easy-to-use platform that offers smarter tax solutions at a fraction of the cost of a traditional accountant.

Simple Return

£49

Self Employed Return

£89

Standard Return

£159

Reviewed Return

£220

Best For

Simple return for employment income only (PAYE)

For self-employment businesses, CIS, or rental income (one source only)

For multiple income sources

Standard return plus an accredited accountant's review for added peace of mind

Submission to HMRC

Instant

Instant

Instant

Reviewed and submitted by an accountant

HMRC-recognised tax return

Full calculation of your tax bill for you to review and approve

VAT included in the price

TaxZap fee can be claimed as an expense next year

Avoid fines and stay compliant

Expert accountant review & filing done for you

Real stories from happy customers.

We have already collected over £15 million for our customers!

Verified User

Really nice website and user interface, easy form and speedy service. Exchanged a few emails with Aaron about some questions I had and his responses were helpful and professional. Great service, highly reco...more

TaxZap Blog

What Is the 40% Tax Bracket in the UK? | 2025 Guide

Working from Home Tax Relief UK | Who Can Claim in 2025?

Mortgage Interest Tax Relief Explained | 2025 Guide

Tax Tips for Income Over £150K UK

Sole Trader Tax Return | Step-by-Step Filing Guide for the UK

Do You Pay Tax on a Rental Property?

Self Assessment for High Earners | Filing Requirements Explained

How Long Does a Tax Refund Take? | Self Assessment Refund Guide UK

How to Register as Self Employed in the UK | Step-by-Step Guide

How to Log Into Your Self Assessment Tax Return | HMRC Online Login Help

CIS Repayment Claim Guide | How to Get Your Tax Back from HMRC

How Do I Find Out My CIS Number? | CIS Explained

What Is the Construction Industry Scheme (CIS)? Your 2025 Guide

How to Register a Company for CIS in 2025

How Does CIS Tax Work? A Complete Guide for UK Contractors and Subcontractors

How to Pay CIS to HMRC: A Step-by-Step Guide for Contractors

Tax Refund for Construction Workers | Your BS Free Guide

What is a CIS Tax Deduction?

HMRC CIS Login: Your Simple Guide for 2025

What Is a CIS Statement? All You Need to Know In 2025

CIS Tax Rebate: How to Claim Your Refund

How to Register for the Construction Industry Scheme (CIS) in the UK

Tax Return for CIS Subcontractors: All You Need To Know In 2025

Tradesman Tax Deductions in the UK: What You Can Claim?

Understanding Crypto Tax Returns in 2025 | Your Expert Guide

How Do I Claim My Mileage Back From HMRC? A Step-by-Step Guide

What Is a UTR Number? Your Guide for 2025

When Does a Self Assessment Tax Return Need to Be Completed?

How to do a CIS Tax Return? A Simple Guide for UK Contractors

Do You Declare Universal Credit on a Self Assessment Tax Return?

Delivery Driver Tax Return: A Complete Guide to Maximising Your Refund

Who Needs to Complete a Self Assessment Tax Return in the UK?

How to File Taxes for Small Business Owners in the UK: A Comprehensive Guide

Landlord Self Assessment Tax Return: A Complete Guide for 2025

Company Director Tax Return: Everything You Need to Know About Filing

Self Employed Tax Credits: What You Can Claim in the UK

Streamlining your Tax Returns with Open Banking: The New Solution for UK Taxpayers

The Ultimate Guide to Filing Your Self Assessment Tax Return in the UK

Unlocking Tax Benefits: A Guide to Claiming Tax Credits in Your UK Self-Assessment!

Maximising Your Tax Refund! A Guide for Construction Workers Registered Under CIS in the UK!

Everything You Need to Know About Your UTR: A Guide for Construction Workers in the UK!

Tax Return Submitted - Where Is My Refund?

Frequently asked questions

Our tax experts are ready to help you with any questions. You can email our team at support@taxzap.co.uk

How do I reset my password?

How do I change my email address?

How much does it cost?

What is the difference between a tax refund and a tax return?

Other questions...

TaxZap in Your Area

Get Support

Legal Stuff

We use cookies to ensure that we give you the best experience on our website. By clicking 'Accept' you agree to our use of cookies. Please see our Cookie Policy for more information.

Decline

Accept